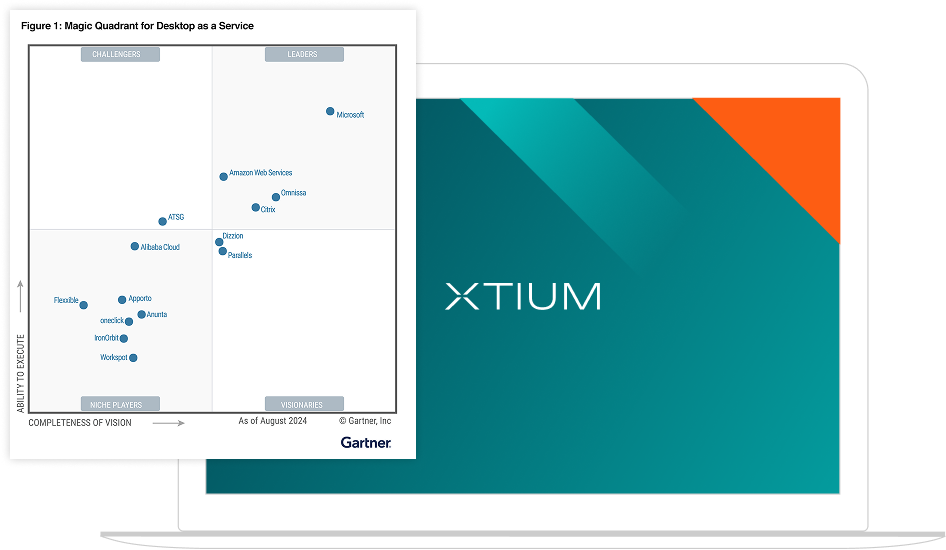

2024 Gartner® Magic Quadrant™ Report for Desktop as a Service

Market Landscape

The DaaS market continues to grow as organizations transition traditional VDI services to the cloud and address the security challenges related to highly distributed work. Gartner® forecasts that DaaS spending will grow from $3.0 billion in 2024 to $4.4 billion in 2028, with a compound annual growth rate of 10%.

The DaaS market has also benefited in the last 12 months due to turmoil in the on-premises VDI market. Gartner® clients have cited Citrix price increase and license bundling, as well as the uncertainty related to the now completed KKR acquisition of Omnissa, as reasons they have moved from on-premises VDI to DaaS.

55%

reported that their organizations have deployed DaaS or are in the process of deploying, 14% are running a proof of concept, 16% are planning to deploy and only 15% have no plans to deploy DaaS. (Source: Gartner® 2024 Digital Workplace Summits)

Self-Assembled DaaS

The client assembles a DaaS solution from components made available by the vendor. Clients select and configure the cloud infrastructure, profile management technology and associated storage. Clients are responsible for configuration and management of the virtual machines. The vendor operates the client-selected components and provides management and updates of the infrastructure through the life of the service.

Vendor-Assembled DaaS

Where the vendor defines most of the solution. The client has less configuration work to perform and focuses on management of the virtual machines.

Vendor-Managed DaaS

Where the full service is managed and supported by the vendor. Managed DaaS vendors generally manage, patch and maintain the virtual machine OS and, in some cases, provide end-user support.

Innovative organizations are pivoting towards hybrid work models, in a bid to enhance agility, and deliver exceptional user experiences. Gartner®, a company that delivers actionable, objective insight to IT executives and their teams, defines Desktop as a Service (DaaS) as “the provision of virtual desktops by public cloud or other service providers”.

This year, Gartner® has released its second ever Magic Quadrant™ for Desktop as a Service (DaaS) report. Gartner® evaluated DaaS providers on the basis of their Completeness of Vision and Ability to Execute.

Vendors in the market range from smaller bootstrapped or private-equity-funded to the largest publicly traded hyperscale cloud vendors. Adoption of DaaS has benefited from the ability to host workloads in locations that allow low network latency, which is especially useful when workers are overseas. Looking forward, Gartner® expects more adoption of solutions that measure and seek to continuously improve digital employee experience.

Recognized as a Challenger in the 2024 Gartner® Magic Quadrant™ for Desktop as a Service, for the 2nd Year

Gartner® has recognized XTIUM (formerly ATSG) in every Gartner® Magic Quadrant™ for Desktop as a Service Report.

"XTIUM's business model is successful with a significant focus on client and user experiences. It expands beyond DaaS to incorporate cloud, network, security and operations services, including service desk."

Must-Have Capabilities

Standard Capabilities

Optional Capabilities

Must-Have Capabilities

- A cloud control plane, from where DaaS operations are performed, that is managed and maintained by the vendor that brokers connections to VMs hosted by a public cloud or other service provider.

- A remote desktop protocol that provides secure access to virtual desktops or applications.

- Support for the ability to connect from a range of endpoints, including those running Windows, macOS, Linux, iOS, Android, Chrome OS, thin clients and common browsers.

- A tool to manage virtual desktop resources, users and assignments.

Standard Capabilities

- The ability to orchestrate persistent and nonpersistent compute and storage resources for Windows 10/11 desktop experiences, or for similar experiences on a Windows Server OS running single-session or multisession VMs.

- Image management technology to allow central updating or management of VMs.

Optional Capabilities

- Vendor-provided compute and storage resources.

- Application-hosting capabilities (published app).

- Monitoring of virtual desktop and application usage, user experience and performance.

- User profile management and application layering and masking.

- Support for GPU workloads.

- Integration or extension of the client’s network into the DaaS environment.

- Multicloud and hybrid deployment options.

- IT service management (ITSM) tool and configuration management database (CMDB) integration.

- Digital employee experience (DEX) or digital experience monitoring (DEM) tool integration.

We believe, our recognition is reflective of our transformative DaaS offering, which delivers reliable, secure, compliant, and scalable Cloud Hosted Virtual Desktops to enterprise clients globally, across all industry verticals.

We believe our automation-driven Cloud Manager is an intuitive cloud orchestration portal, which delivers seamless access to real-time usage stats, digital employee experience (DEX) insights, VM monitoring and management, auto-scaling feature, application lifecycle management, and more, all from a single user interface.

Read the full report to:

- Evaluate the strengths and cautions of the 14 vendors shortlisted by Gartner®

- Get quickly educated about the market’s leading vendors and how they’re competitively positioned

- Understand the marketing definition along with must-have and optional capabilities

Vendor Strengths and Cautions

Alibaba Cloud

Alibaba Cloud is a Niche Player in this Magic Quadrant. Its Elastic Desktop Service provides a vendor-assembled desktop as a service. Operations are mostly focused in Asia/Pacific, with most clients located within China and a smaller presence in North America and Europe. Clients tend to be small and midsize enterprises primarily in government, education and regulated industries.

Alibaba Cloud provides its own range of endpoints to complement its DaaS solution and uses its own proprietary remote desktop protocol, Adaptive Streaming Protocol (ASP). In support of environmental sustainability, Alibaba Cloud has committed to reduce its emissions and has set targets to reach carbon neutrality by 2030.

Strengths

- Operations: Alibaba Cloud has global presence with its hyperscale cloud. It has more engineers and operations staff, as well as more users and virtual desktops under management, than most other vendors. The company has the highest availability service level of all vendors in this report at 99.975%, measured monthly, with service credits for breaches.

- Product bundles: The Elastic Desktop Service offers a broad range of virtual desktop options and is designed with clear sizing options for enterprise use cases. Clients using Alibaba Cloud can minimize the number of vendors providing virtual desktops to workers because it includes a comprehensive set of capabilities, including analytics and options for endpoint devices. In addition to virtual desktops, Alibaba Cloud offers virtual applications running on Windows or Linux, as well as virtual mobile applications.

- Sustained growth: Alibaba Cloud reported that the number of virtual machines under management grew significantly from the previous Magic Quadrant, and growth was higher than most other vendors. It has sustained growth year over year and has set realistic growth targets, including plans to focus on expansion in the Middle East over the next 12 months

Cautions

- Global market presence: Alibaba Cloud has been active in its home market (China) and adjacent regions (Southeast Asia). Broader global adoption is weaker, and the vendor will need to expand its market focus to challenge the Leaders in the DaaS market. It will need to overcome the challenge of trust in a market where geopolitics impacts adoption of products from Chinese vendors in North America and Europe, the largest markets globally.

- Industry vertical strategies: Alibaba Cloud has no vertical-aligned offerings or marketing aligned with the Elastic Desktop Service, requiring clients with specific vertical requirements to explore integration options during the sale and design phases with Alibaba.

- Lack of customer success management: Alibaba Cloud focuses primarily on an online engagement model for learning and certification of enterprise clients’ operations team. It provides onboarding and migration support, but no aligned customer success management service.

Amazon Web Services

Amazon Web Services (AWS) is a Leader in this Magic Quadrant. Amazon Workspaces offers vendor-assembled desktop-as-a-service options, while Amazon WorkSpaces Core offers self-assembled options. Amazon WorkSpaces Web provides access to web applications, and Amazon AppStream 2.0 offers application virtualization with multisession configurations. Its operations are global, with clients mainly from medium and large enterprises.

In August 2023, Microsoft license terms changed to allow Microsoft 365 applications, including Microsoft Teams, to operate on Amazon WorkSpaces. In November 2023, AWS launched the Amazon WorkSpaces Thin Client, fulfilled through Amazon Business, providing clients with an end-to-end service for onboarding employees. In support of environmental sustainability, AWS is targeting 2040 for net-zero carbon emissions — the same deadline for the whole Amazon group.

Strengths

- Geographic strategy: AWS has a strong regional presence; only vendors with multicloud capabilities can host workloads in more locations. Amazon WorkSpaces’ integration with AWS Global Accelerator provides low-latency interconnections between regions for high-availability use cases.

- Operations: AWS provides DaaS operations and local-language support in all regions where its cloud is deployed. Its operations include cost optimization for customers. Amazon WorkSpaces’ capabilities include operations interfaces and automation. Gartner rarely observes clients needing to purchase additional thirdparty tools with Amazon WorkSpaces, although Amazon WorkSpaces Core is designed for integration with third parties.

- Viability: AWS has significant DaaS revenue, alongside a diverse portfolio of cloud services. AWS is one of the few hyperscale vendors within this Magic Quadrant and is not reliant on others for the Amazon WorkSpaces virtual desktop software or the remote network technology, the WorkSpaces Streaming Protocol.

Cautions

- Marketing execution: AWS primarily targets existing customers with its DaaS services rather than engaging in a broader marketing effort to attract new customers. Gartner believes this may reduce the pace of growth for AWS.

- Market understanding: Amazon WorkSpaces lacks multisession capabilities, which inhibits AWS’ ability to optimally address the lowest-cost use cases, such as contact centers and business process outsourcing.

- Innovation: The pace of change from AWS is sometimes slower than from other DaaS vendors — for example, Windows Server 2022 support arrived two years after it launched. Customers should engage with AWS to keep abreast of roadmaps for key capabilities they require.

Anunta

Anunta is a Niche Player in this Magic Quadrant. Its Enterprise DaaS and Packaged DaaS offerings provide a vendor-assembled and vendor-managed desktop as a service. Its operations are focused in North America, Asia and the Middle East. Clients tend to be midsize and large enterprises across industry sectors. Anunta has embedded automation, streamlined onboarding and proactive experience management within its offerings. It has a range of offerings, from DaaS optimization tools to full DaaS services.

Anunta did not provide evidence of targets to become carbon-neutral for environmental sustainability.

Strengths

- Product strategy: Anunta offers automation and orchestration within its offering and provides comprehensive design, onboarding and migration support. Its Packaged DaaS is a predesigned offering, whereas its Enterprise DaaS is designed from standard building blocks and shaped to meet client needs.

- Business model: Anunta reports continued growth in revenue and the number of clients, with a focus on geographical and market expansion. Its existing client base regions include Asia, Australia, Europe, India, the Middle East and North America. North America is Anunta’s largest market, delivering 60% of the vendor’s revenue. Anunta focuses on reducing and continually optimizing costs for clients and actively measures customer and end-user satisfaction.

- Market responsiveness: Anunta dynamically adjusts its offering strategy due to continually changing market conditions. For example, in 2023, it launched a SaaSbased cloud cost optimization tool. It has actively expanded to new geographic markets, leveraging strategic partnerships with large existing client-bases that would benefit from Anunta’s DaaS offerings.

Cautions

- Marketing execution: Market awareness of Anunta’s brand and offering is limited. More than 75% of its revenue is attributed to DaaS. Given the limited awareness of DaaS, clients should seek assurance that Anunta plans to increase its market awareness, thus ensuring long-term viability.

- Marketing strategy: Anunta is active on social media platforms and has run joint marketing events with Microsoft and VMware. Despite these efforts, Gartner’s clients seldom mention Anunta during inquiry calls.

- Sales and execution: Anunta reports consistent growth rates ahead of Gartner market forecasts, but we do not observe conquest sales. Its offering design relies on other vendors, which can impact Anunta’s ability to maintain competitive pricing.

Apporto

Apporto is a Niche Player in this Magic Quadrant. Its Virtual Computer Lab and Secure Mobile Workspaces offerings provide self-assembled, vendor-assembled and vendormanaged desktop as a service. Its operations are mostly focused in North America and Europe, but are available globally. Clients tend to be small and midsize enterprises, with a large percentage of clients in higher education.

Apporto has redesigned its control-plane platform for cloud, on-premises and hybrid deployments. The network protocol has also been redesigned to improve experiences with rich graphics and media. Apporto did not provide evidence of targets to become carbon neutral for environmental sustainability.

Strengths

- Business model: Apporto is increasing its channel presence beyond only supporting direct sales. This further enables the vendor’s expansion into new markets, such as financial services, and new geographies. For example, Apporto has strengthened its presence in Europe.

- Vertical/industry strategy: Apporto serves a broad range of industries with a horizontal set of capabilities, but it also has deep vertical focus for higher education. Its higher-education-focused offering integrates with learning management systems to allow capacity to be booked for lessons and provides features that enable tutors to shadow the work of students within learning labs.

- Customer experience: Apporto allows volume reductions three times each year, which is uncommon in this market. It has a robust onboarding process and customer success teams, and it actively seeks customer sentiment feedback alongside performance monitoring.

Cautions

- Marketing execution: Apporto has reshaped its offering to address an increased volume of clients looking to migrate from traditional on-premises virtual desktop infrastructure (VDI) deployments. Its marketing message aligns the reshaped offering, but client awareness remains low.

- Geographic strategy: Apporto targets the North American and European markets, which limits its applicability for other regions. The company is growing its DaaS business, but its resources will be stretched until it scales the number of internal resources and channel partners.

- Innovation: Apporto continues to improve its offering by incorporating generative AI (GenAI). However, much of this investment is focused on catching up with competitor capabilities, such as supporting workloads on-premises. Much of the innovation planned is integration with vendors in adjacent markets (for example, single sign-on, endpoint operating systems and learning management systems), which is not differentiated.

XTIUM, Formerly ATSG

XTIUM, Formerly ATSG is a Challenger in this Magic Quadrant. Its Cloud PC offering is a vendor-managed DaaS offering and includes desktop and application virtualization options. Services are available globally and operated from delivery centers in North America and Asia. Clients tend to be midsize enterprises, with some large enterprise customers that are generally headquartered in North America. Clients are from all industry verticals, but most commonly healthcare, hospitality and education.

XTIUM, Formerly ATSG has integrated digital employee experience (DEX) measurement capabilities into its DaaS offerings and proactively focuses on providing DEX functionality. XTIUM, Formerly ATSG has targets to become carbon-neutral for environmental sustainability.

Strengths

- Overall viability: XTIUM, Formerly ATSG operations are stable, its leadership has had no significant changes, and its business model is successful with a significant focus on client and user experiences. It expands beyond DaaS to incorporate cloud, network, security and operations services, including service desk.

- Product and service: In its DaaS offering, XTIUM, Formerly ATSG focuses on services and automation, which allow workloads to run in public clouds, its private cloud, onpremises or in hybrid configurations. It has built its offering around its XTIUM Cloud Manager for DaaS, which provides clients with a low-touch, highly automated experience.

- Market responsiveness/track record: XTIUM, Formerly ATSG initially enabled DaaS when work-fromhome mandates required rapid scaling. It has adjusted the shape and design of its offering because more clients have requirements for hybrid deployments dealing with on-premises application virtualization alongside cloud-hosted desktops.

Cautions

- Low growth rates: In the previous 12 months, XTIUM, Formerly ATSG has not grown its installed base at the same rate as others in the market. XTIUM, Formerly ATSG must face this challenge in a very competitive market.

- Vertical/industry strategy: XTIUM, Formerly ATSG serves clients in a range of industries, with the largest being travel and hospitality. Vertical products are not available, and therefore, its products require configuration per deployment for regulatory compliance.

- Partner reliance: XTIUM, Formerly ATSG is the largest vendor to rely on third parties for brokering and virtual desktop technologies. It has intellectual property in the operation and management of DaaS. Its reliance on third parties means it is at higher risk of price disruption compared with Leaders and Visionaries in this Magic Quadrant.

Citrix

Citrix is a Leader in this Magic Quadrant. Citrix is among a small number of vendors to offer all three DaaS options (self-assembled, vendor-assembled and vendor-managed), although most Gartner clients use the Citrix cloud control plane to operate self-assembled capabilities. Citrix is globally available and targets clients from all industry sectors and all scales of enterprise, although its products are most commonly used in larger enterprises with regulatory compliance requirements.

Citrix supports workloads on all major clouds. Citrix states that its environmental sustainability plans are being updated to reduce carbon emissions, but did not share a net-zero target.

Strengths

- Configurability and extensibility: Citrix enables simple out-of-the-box experiences for organizations to deploy DaaS but also offers deep configurability to meet the most complex enterprise requirements. Gartner identifies Citrix’s most strategic partnerships being with Microsoft and Google, among its strong partner ecosystem.

- Operations benefits: Citrix provides clients with out-of-the-box capabilities to manage spending, scale DaaS environments intelligently and reduce the effort required to operate a DaaS environment. Many DaaS vendors, including some in this Magic Quadrant, leverage Citrix technology to operate their DaaS environments.

- Market focus: Citrix focuses on enabling secure access to desktops and applications, and this remains the core tenet of its DaaS offering. Its products are most suited to complex application and desktop use cases. Citrix is now supporting the most complex deployments by leveraging DaaS alongside on-premises workloads.

Cautions

- Client sentiment: Gartner inquiry calls with Citrix clients of all sizes highlight continued dissatisfaction with their commercial relationship. Clients consistently identify a lack of contractual flexibility, fixed terms and conditions, the inability to negotiate volume changes and a general lack of client empathy during negotiations.

- License bundling: Citrix has decreased the number of license options it sells to two DaaS offerings (Citrix Universal Hybrid Multi-Cloud and, by invitation only, Citrix Platform License). This bundling provides Citrix, and its channel partners, with a simpler portfolio to sell, and it reduces its cost of sale. Gartner clients should assess which features of the new licenses they will utilize, today and in the future, because some Gartner clients report unused bundle features.

- Focus on the largest clients: The majority of Citrix customers now transact and gain support through channel partners. Citrix engages directly with only the largest enterprises; clients from midsize enterprises should plan on working with a channel reseller. Smaller enterprises should plan on buying Citrix services through a cloud solution provider. This narrow focus on large customers and product bundling may make Citrix less relevant for midsize organizations.

Dizzion

Dizzion is a Visionary in this Magic Quadrant. Its DaaS offerings — Flex, Managed, Complete and +Compliance — provide vendor-assembled and vendor-managed solutions. Its operations are mostly focused in North America, EMEA and Asia, but are available globally. Clients tend to be small or midsize enterprises. Dizzion has focused on automation, resilience and compliance through investment in its self-developed management plane, a resilient cloud architecture model and numerous compliance certifications, including the Payment Card Industry Data Security Standard (PCI DSS), the Health Insurance Portability and Accountability Act (HIPAA), the General Data Protection Regulation (GDPR) and Service Organization Control 2 (SOC 2). In support of environmental sustainability, Dizzion stated its aim to reach a carbon-neutral goal, but did not detail targets for when this would be achieved.

In 2023, Dizzion acquired Frame Platform and integrated the solution as its primary DaaS architecture earlier this year, focusing on multicloud development. The Horizon platform will still serve enterprise customers with complex needs.

Strengths

- Multicloud: Dizzion’s Frame Platform solution offers a centralized cloud control plane with workloads supported natively in public cloud (on AWS, Google Cloud Platform [GCP], IBM Cloud, and Microsoft Azure), in private clouds with Nutanix AHV, and on bare-metal AWS and Azure with Nutanix NC2. It also provides customers with hybrid solutions.

- Ease of use: Dizzion allows customers to get started with a trial and convert to permanent licenses, onboard/offboard users, deploy desktops with a high degree of automation, easily add apps for publishing, and build a solution for external customers. Dizzion offers a simple pricing model for minimal assistance (bring your own infrastructure) or fully managed service in the cloud.

- Growth opportunities: With its proprietary platform that is multicloud- and hybridcapable, Dizzion is well-positioned to take advantage of market growth and compete with vendors offering hybrid solutions.

Cautions

- Duplicate technology: Dizzion has clients on two technology stacks: its own Frame platform and Omnissa Horizon. It is costly to maintain support for two technologies, and Gartner expects Dizzion will migrate customers to the Frame platform over the coming years.

- Vertical integration: Dizzion focuses on architecture, engineering and construction, business process outsourcing, financial services, higher education, and technology verticals. Dizzion has two architectures: one based on Frame platform and another on Omnissa Horizon. Clients should ensure the selected Dizzion offering meets their industry vertical requirements — for example, in healthcare, the Frame platform lacks the validation with electronic medical record applications such as Epic.

- Market awareness: Dizzion is not well-known with buyers who lead end-user services and is infrequently mentioned by Gartner clients. To sustain growth, Dizzion will need to target marketing for those end-user service leaders who would benefit from multicloud or hybrid use cases.

Flexxible

Flexxible is a Niche Player in this Magic Quadrant. Its FlexxDesktop offering provides vendor-assembled and vendor-managed DaaS capabilities. Its offerings are available globally, with operations centers in North America, Europe, India and Latin America, and through key systems integrator partnerships. Clients tend to be midsize and large enterprises.

Flexxible focuses on providing an automation-first platform that can operate DaaS services in various clouds using a range of virtualization technologies, from Microsoft to Citrix. In support of environmental sustainability, Flexxible stated that it is developing plans to reduce carbon emissions, but did not share any net-zero targets.

Strengths

- Market responsiveness: Flexxible has a long tenure in the market and supports large systems integrators and clients that operate DaaS. It caters to enterprise clients, managed service providers and systems integrators, with key client use cases focusing on automation.

- Viability: Flexxible can support a range of cloud platforms, has strong automation frameworks and can easily integrate with customer tools and processes. Flexxible has a modular architecture, including automation and DEX management. Analytics, diagnostics, DEX capabilities, automation and Level 1-support portal modules are included in its FlexxDesktop offering.

- Product or service: The FlexxDesktop offering has several analytics capabilities that make it possible to measure experience levels. Flexxible is one of a handful of DaaS vendors that offers experience-level agreements (XLAs). Flexxible also measures levels of proactive operations — that is, the number of issues that were resolved without being reported by clients — as part of client contracts.

Cautions

- Customer awareness: Client awareness of Flexxible remains low; they are rarely mentioned by clients during Gartner inquiry interactions on DaaS. Therefore, its deployment base is small, and growth is in-line with market forecasts and lower than the majority of vendors.

- Market understanding: Flexxible has produced few DaaS product enhancements in the previous 12 months. It has focused more on its digital employee experience management tool. Clients engaging with Flexxible should assess its roadmap and investment focus to ensure these align with their digital workplace strategy.

- Marketing focus: Flexxible has increased its focus on client- and security-facing offerings. DaaS is a lower priority, is marketed at a much lower level, is somewhat hidden on Flexxible’s website and is no longer mentioned in social media channels such as LinkedIn.

IronOrbit

IronOrbit is a Niche Player in this Magic Quadrant. Its INFINITY Workspaces offering provides a vendor-managed DaaS solution for a range of use cases but is most common in high-performance computing that requires graphical processing units (GPUs). Its offerings are available globally, but most of its customers and operations are based in North America.

IronOrbit has developed its DaaS offering to run within its private cloud platform or on Microsoft Azure. In support of environmental sustainability, IronOrbit did not share targets or plans to reach net-zero, but aims to align with that goal.

Strengths

- Market responsiveness: IronOrbit focuses on clients with GPU-enabled applications for industries such as construction, engineering and architecture. It has adapted its offerings as new GPUs were released and as software vendors released new applications (for example, Autodesk, Dassault Systèmes and Siemens).

- Business model: IronOrbit has focused on turnkeylike services, resulting in low levels of effort and skills required from clients adopting its DaaS offering. IronOrbit designs its offerings to provide modularity, recovery options and comprehensive SLAs and has more flexibility than many DaaS solutions.

- Sales strategy: IronOrbit targets midsize enterprises with a vertical strategy aligned to architecture, engineering and construction, healthcare, manufacturing, financial services, and legal services. Its focus on vertical use cases and the applications used flows back into the design of its offering, so sales activities are better aligned to client requirements in the targeted markets.

Cautions

- Marketing execution: IronOrbit could focus its marketing to reach more end-user service leaders responsible for DaaS and scale its offering. Its offering has not been mentioned by Gartner clients during inquiry calls.

- Customer experience: IronOrbit adopts a boutique approach in its DaaS offering, retaining fewer users than Leaders in this Magic Quadrant. Its customer success management is exclusively for larger deployments as part of a premium support package. Clients should work with IronOrbit to define the engagement and support model appropriate to their needs.

- Geographic strategy: IronOrbit users and workloads can reside in multiple regions. However, with a primary focus on North America and a limited global footprint, this offering is less attractive for enterprises from other regions. Clients should assess regional requirements when engaging with IronOrbit.

Microsoft

Microsoft is a Leader in this Magic Quadrant. Its offerings include Azure Virtual Desktop, Windows 365 and Microsoft Dev Box. The offerings provide self-assembled and vendorassembled DaaS. Its operations are global, with clients in small, midsize and large enterprises. Microsoft has integrated Azure, Microsoft Intune and Windows to deliver unique and exclusive DaaS capabilities — for example, Windows 10/11 Enterprise multisession, which enables optimized Azure resource utilization when using Windows.

In support of environmental sustainability, Microsoft evidenced plans to be carbon-neutral and is the only vendor that showed plans to be carbon-negative.

Strengths

- Operations: Gartner estimates that Microsoft has the largest installed base in this market. Microsoft’s installed base grew in absolute terms more than any other competitor in this research over the past 12 months. Discussions with users of Gartner’s client inquiry service, together with evidence from Gartner Peer Insights, indicate positive sentiments as Microsoft scales its offerings and operations.

- Overall viability: Microsoft has an entire ecosystem of end-user service offerings, including Windows, Microsoft Intune, Microsoft 365, Entra ID, FSLogix and various GenAI Copilot solutions. Its DaaS offerings have grown to a dominant position in the market, and Microsoft’s scale and breadth of offerings enhances its overall viability.

- Marketing execution: Microsoft consistently communicates its offering strategies, providing documentation and learning modules through its website, social media and events. It also publishes thought leadership and white papers on topics such as IT sustainability and the future of work. Gartner client inquiry indicates that most of our clients already have a basic understanding of at least one of Microsoft’s DaaS offerings.

Cautions

- On-premises capabilities: Azure Virtual Desktop on-premises using Azure Stack HCI is not as capable as the offerings from traditional VDI vendors. Traditional vendors have differentiation in managing application virtualization, a common use case for on-premises solutions. Microsoft has not been observed displacing on-premises application solutions.

- Variable pace of change: Microsoft has been slower to build some capabilities into its offerings. For example, offline mode for Windows 365 is not yet available but was announced as a strategy at launch in 2021, and modernizing Teams for VDI has been slow. Updates that require other groups within Microsoft to perform work have been slowest to launch.

- Sales execution: Gartner observes Microsoft marketing and positioning Windows 365 as its lead DaaS solution. Clients should determine if their use cases may be better served by consumption-based pricing and customization options in Azure Virtual Desktop compared with user-license-based pricing for standardized Windows 365.

Omnissa

Omnissa is a Leader in this Magic Quadrant. Omnissa Horizon Cloud Service offers a range of self-assembled to vendor-assembled DaaS solutions. Horizon Cloud Service integrates with cloud infrastructure services from AWS, Google, Microsoft and others to provide its full DaaS capability to clients. Omnissa has integrated its offerings with Microsoft’s DaaS offerings and is simultaneously a Microsoft partner and a competitor. Horizon Cloud Service is globally available and adopted by clients from all industry sectors and all scales of enterprise. It is most commonly used in larger enterprises with regulatory requirements. In support of environmental sustainability, Omnissa is yet to define its targets to become carbon-neutral.

Since the previous Magic Quadrant, Broadcom acquired VMware, renamed the End-User Computing (EUC) Division as Omnissa in April 2024, and then sold to KKR. As of 1 July 2024, Omnissa is operating independently of Broadcom software under KKR ownership. The separation of Omnissa from Broadcom has been completed in the U.S. and Ireland, with other jurisdictions to follow.

Strengths

- Range of deployment options: Horizon Cloud Service is seen by Gartner in a range of enterprise scenarios and has particular strengths with hybrid deployments that require on-premises and cloud workloads. Horizon Cloud Service enables a range of desktop and application virtualization options.

- Offering integration: Omnissa is a significant player in the digital employee experience market, and customers can take advantage of the close integration of Omnissa Workspace ONE Experience Management within Horizon Cloud Service instead of having to work with an outside vendor for DEX capabilities. Similarly, Workspace ONE Unified Endpoint Management supports Day 2 management of Horizon Cloud Service persistent desktops for updates, patches, policies and so on.

- Healthcare integration: Horizon Cloud Service is one of the three DaaS solutions validated by healthcare records vendor Epic. This is a sizable vertical for the DaaS market and often requires substantial customization, which Horizon enables.

Cautions

- Marketing: Market sentiment for Horizon is often mixed, with it previously being owned by Broadcom. Clients should work closely with Omnissa over the next 12 months to allow time to assess the new organization’s culture and client focus.

- Level of support: Omnissa technology and bundling should be relatively easy to separate from VMware. Gartner client inquiry indicates concerns regarding its ability to maintain the same level of support globally with Omnissa’s dedicated support team. Clients should work with Omnissa to alleviate any concerns and mitigate risks.

- Development: Omnissa may have slowed the development of Horizon’s nextgeneration cloud control plane on some cloud platforms during the recent changes of ownership, but it is now an independent enterprise. The independence will offer Omnissa more opportunity to develop a single multicloud platform and create new partnerships that previously conflicted with its hypervisor parent.

oneclick

oneclick is a Niche Player in this Magic Quadrant. Its oneclick DaaS platform offers a selfassembled, vendor-assembled and vendor-managed offering more commonly utilized by cloud service providers (CSPs), although it sells directly to enterprises. The CSPs are generally very large enterprises servicing small and midsize end-user clients. Its operations are mostly focused in Europe and Asia.

oneclick has developed a cloud platform that allows clients to operate workloads in numerous clouds via an API framework. In support of environmental sustainability, oneclick shared targets to reduce carbon emissions by 30% by 2030, but did not share a net-zero target.

Strengths

- Geographic strategy: oneclick has a clear geographic focus, with partnership models in place to continue growth in Europe and Asia. oneclick also has plans to expand into North America.

- Business model: oneclick can offer service levels that meet client requirements across both enterprise customers and cloud service providers. Its business model includes a high degree of automation alongside measuring digital experiences, with the goal to make its offering more human-centric.

- Operations: Modular architecture and a choice of service levels results in an offering that can, compared with others in this Magic Quadrant, run on the broadest range of hyperscale and regional cloud providers, as well as in on-premises and hybrid deployments. Options range from base services, including orchestration and management of virtual desktops, and extend to optionally include network management, managed security, backup and digital rights management.

Cautions

- Marketing execution: oneclick has a strong web presence, but its overall marketing has not raised awareness of its offering. Gartner clients have not mentioned oneclick during inquiry calls.

- Customer experience: oneclick’s offering has a comprehensive set of service options, but many clients are service providers and adopt base services. The result is that many of oneclick’s services are used by small businesses. Large enterprises should seek evidence that oneclick can effectively operate at their scale.

- Market understanding: oneclick has focused on horizontal services and primarily targeted the requirements of managed service providers. Its installed base tends to be smaller organizations. oneclick does not have specific vertical industry presence such as banking integrations, although it is International Organization for Standardization (ISO) 27001-certified and GDPR-compliant.

Parallels

Parallels is a Visionary in this Magic Quadrant. Its Parallels DaaS offering has both selfassembled and vendor-assembled capabilities, and is hosted on Microsoft Azure. The vendor offers a range of features, such as multisession, single session, dedicated, pooled nonpersistent, published app, vGPU, and full Windows or Linux desktops. The vendor mostly serves small or midsize businesses, with a focus on education, healthcare and government verticals.

Parallels has developed its DaaS solution — which includes image management, integration with FSLogix, support for MSIX app attach and cost-saving techniques — on Microsoft Azure. In support of environmental sustainability, Parallels did not share any targets to reach net-zero carbon emissions.

Strengths

- Growth opportunity: Parallels is capitalizing on the DaaS and VDI market turbulence by positioning itself as an alternative to mature vendors. Clients report that moving to Parallels is a short learning curve for Citrix administrators.

- Azure integration: Parallels DaaS, which can be optionally purchased and deployed via Azure Marketplace, offers image management with template versioning, deploy/configure FSLogix, simple deployment of gateway/load balancer appliance, universal printing and storage cost-saving techniques.

- Licensing: Parallels’ virtual desktop offerings — DaaS and its Remote Application Server (RAS) — both have simple license models that are easy to understand. DaaS is licensed on a named user basis (a minimum of 15 users and a one-year commitment).

Cautions

- Offering: Parallels’ DaaS is a new offering with limited deployments at scale. However, Parallels has a long history and experience in VDI with its more mature RAS solution.

- Remote Desktop Protocol (RDP): Parallels’ protocol is solid and based on RDP with enhancements and User Datagram Protocol (UDP). RDP traditionally struggles with long-distance connections and connections with high latency or packet instability. Clients should test Parallels’ mitigations, including RDP protocol performance — for example, testing local gateway locations designed to optimize network performance.

- Growth: Parallels may have a boost in growth and development from market turbulence, but that is a short-term burst. A well-formed long-term growth strategy will be essential to maintain present growth rates.

Workspot

Workspot is a Niche Player in this Magic Quadrant. Workspot offers self-assembled DaaS solutions hosted on the major hyperscale cloud platforms (Azure, AWS and GCP) and onpremises infrastructure. Workspot is globally available and applicable to all industry verticals. Customer use cases are split between rich graphics requirements, such as manufacturing and AEC (architecture, engineering and construction), and general enterprise workloads.

Workspot has significant experience and intellectual property in optimizing, monitoring and operating DaaS. In support of environmental sustainability, Workspot shared guidance that it has selected hyperscale locations most likely to be carbon-neutral by 2028, but did not offer a target to reach net-zero emissions.

Strengths

- Market responsiveness/record: Workspot has provided DaaS services since 2012 and has remained focused on DaaS, now adding VDI. It is client-focused and responsive to client requests, reshaping its offerings to meet new requirements — for example, switching to a self-assembled DaaS model based on client demand.

- Business model: Workspot has switched to a self-assembled DaaS model in order to target clients with VDI skills that are now migrating to the cloud, as well as to increase its proportion of use by managed service providers.

- Vertical/industry strategy: Workspot has clear markets within which it can differentiate. Its ability to support high-performance GPU workloads makes it an attractive offering for architecture, engineering, construction and manufacturing. Its support for hybrid and on-premises workloads is important for customers that have not adopted a cloud-first strategy.

Cautions

- Customer experience: Workspot has a defined methodology to support clients in designing and deploying its offerings, but beyond this, it offers limited ongoing customer success management compared with other vendors in this Magic Quadrant. Ensure clarity of which success services will be available when engaging with Workspot.

- Low adoption: Despite its ability to scale to very high volumes, Workspot has lower adoption compared with other vendors in this Magic Quadrant. Gartner clients should work with Workspot to fully exploit its potential.

- Operations: Workspot has transitioned from a vendor-assembled offering to a selfassembled offering. This is a significant change from the DaaS model where Workspot packaged infrastructure as a service (IaaS) into the cost of the service to where the Workspot offering manages a customer- provided and - funded IaaS architecture. As a result, it is in direct competition with all vendors in the Leaders quadrant. Gartner clients should assess Workspot’s differentiation during procurement cycles.

Industry-recognized and certified to support your IT needs

Trusted by 1,400+ mid-size and enterprise companies, we operate as an extension of your team—solving problems with urgency and accountability so you can focus on strategy, not firefighting. Our deep bench of technology specialists brings proven frameworks and real-world experience to help you secure, scale and streamline operations with fewer resources. Stop juggling vendors. Stop fighting uphill battles. Work with an IT partner who gets IT.